As is well known, an experienced Chief Financial Officer (CFO) is an essential component of all company operations. A qualified Chief Financial Officer is responsible for financial planning, determining tax strategies, managing internal controls and legal compliance, and sometimes making investment decisions and managing capital structures, always playing an important role that cannot be ignored.

For most startups and small to medium-sized companies, finding a senior finance manager can be a challenge, not to mention the financial burden of hiring an internal CFO. That’s why Simon’s CFO outsourcing services are perfect for you and your company in China! You will enjoy the excellent financial management performance that full-time CFOs can offer at the cost of part-time senior financial experts! We will also help you establish a comprehensive financial management framework to drive greater success in your operations and business!

Experienced chief financial officers of international companies dealing with cross-border investments have a good understanding of how to apply International Financial Reporting Standards (IFRS) to manage Chinese accounting. They excel at seamlessly integrating local financial software data into the internal financial systems of enterprises.

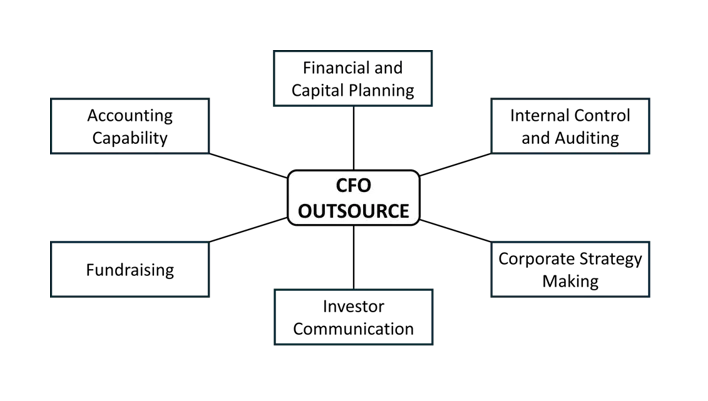

What are the contents of Chief Financial Officer outsourcing services?

Nowadays, company decisions heavily rely on data and the potential information it contains. Helping your company extract valuable insights from financial data is a key factor in Simon CFO outsourcing services, which simplifies the strategic planning process from “paper questions” to multiple-choice questions and transforms your business in China from “intuitive thinking” to “data-driven thinking”.

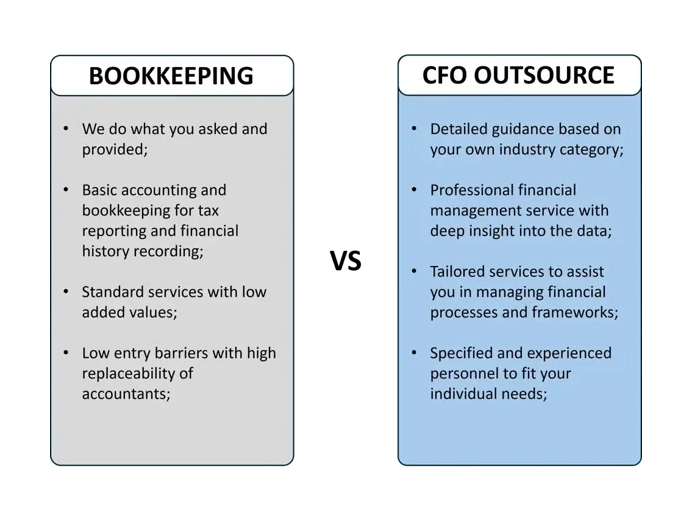

What are the differences between bookkeeping and CFO outsourcing?

What are the differences between bookkeeping and CFO outsourcing?

Traditional bookkeeping services focus on basic daily financial history records and tax reports, documenting your company’s transactions. These services can be standard because the processes and requirements are very similar.

Traditional bookkeeping services focus on basic daily financial history records and tax reports, documenting your company’s transactions. These services can be standard because the processes and requirements are very similar.

On the other hand, CFO outsourcing emphasizes the importance of financial management and advance planning, aimed at managing the more complex financial aspects of the company. A comprehensive financial management framework can support and assist your company’s strategic decision-making, provide customized solutions, and gain a deep understanding of your company’s operations in China.

Why should your company consider outsourcing CFO?

Considering the importance of the Chief Financial Officer to your business operations in China, there are many reasons to choose Chief Financial Officer outsourcing services:

- Cost and time benefits: Choosing to outsource as a Chief Financial Officer can help your company fulfill the responsibilities of a full-time accountant, rather than a part-time one. Meanwhile, as you may not be a professional financial expert yourself, it can be difficult to fully understand complex terminology, especially during the startup phase. Chief Financial Officer

- Outsourcing can provide financial statements that business owners can understand, ensuring effective communication from a management perspective

- Not just accountants: we are not just outsourced senior finance managers; We provide services that suit your own financial needs. If you suddenly leave, be prepared to change personnel at any time, so ensure there is a qualified professional to avoid any inconsistencies in daily management

- Tailored financial solutions: We complete all financial tasks based on your company’s basic business operations and have in-depth discussions with business owners every month. This can ensure that they have a clear and accurate understanding of their financial data and accounting information

- Strategic Financial Insight: We conduct in-depth research on your company’s fundamental operations to provide strategic recommendations. When problems arise, we will provide professional advice in a timely manner. Business owners facing financial issues can immediately clarify these issues with our accountants to ensure timely and effective solutions

- Confidentiality Commitment: As a service provider, we can sign confidentiality agreements with enterprises to ensure strict confidentiality of all operational and financial data

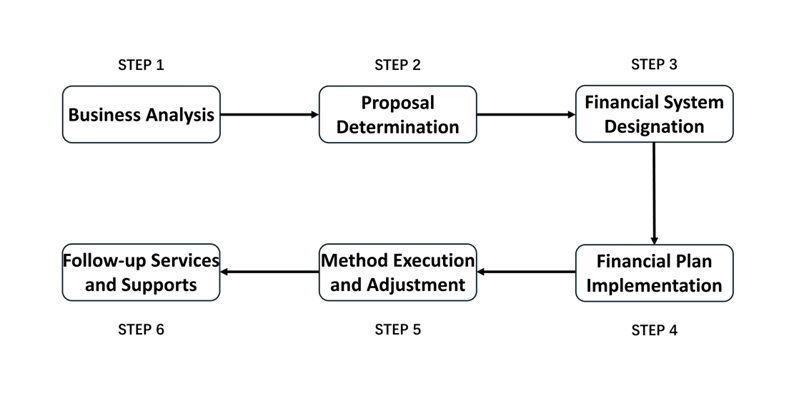

Simon CFO Outsourcing Service Workflow

Our team of professional accountants, tax and payroll personnel provides effective outsourcing services for your personal business operations in China. We fully understand that in order to maximize the value of our client’s company, you must focus your limited operational resources on core business activities. Our experienced outsourcing consultants enhance this process by reviewing business workflows and building business improvement systems that meet your own needs. Our professional service features include:

Our team of professional accountants, tax and payroll personnel provides effective outsourcing services for your personal business operations in China. We fully understand that in order to maximize the value of our client’s company, you must focus your limited operational resources on core business activities. Our experienced outsourcing consultants enhance this process by reviewing business workflows and building business improvement systems that meet your own needs. Our professional service features include:

- Strict after-sales quality control:All of our outsourced personnel are required to receive rigorous training tailored to their positions, job responsibilities, and duties.

- Transition management:The backup financial manager is ready to take over the position at any time. They will be assigned to manage your company one month prior to any changes to ensure that your company is not affected.

- Customized services:We will select the most suitable financial management software and system for you, and customize high-quality financial reports according to your business environment. In addition, we offer a variety of language services to meet your needs, including English, Mandarin, and Cantonese.

- High quality one-stop service:Our service team is composed of professionals from different backgrounds who are closely related to your company’s financial management, including certified public accountants, tax consultants, and lawyers. They will collaborate to develop strategies for your company’s management, so you don’t have to repeatedly communicate with different consultants, which will greatly save you time and energy.

- Flexible management:Whether your company is just a startup in China or has developed into a large listed entity, we will provide personalized and flexible solutions based on your company’s size and specific needs.

Case Study of Simon’s Chief Financial Officer Outsourcing Services

In this case study, we presented the service packages and related quotes selected by clients who chose Simon CFO outsourcing services. Please note that our pricing may vary depending on the size and specific needs of your company. If you would like to learn more about how Simon’s services can benefit your operations in China, please feel free to arrange a meeting with us at any time.

Chief Financial Officer Outsourcing Service Package

| Position | Service Items | Pice |

| Guangzhou, Guangdong Province |

|

60000 yuan/year |

Selected other services

| Service Items | Describe | Price |

| Tax control equipment management |

|

0 (included in the service package) |

| Annual inspection and report | Business Annual Report Service

|

0 (included in the service package) |

| License modification service (excluding relocation) |

|

2000 |

| Regional relocation permit change service (no tax declaration required) |

|

2000 |

| Relocation permit change service (including tax clearance) |

|

5000 |

Why choose Simon?

Rapid Processing

With experienced team members, we can handle your project faster than others.

Unsuccessful, no charge

Simon promises that we will only charge after your project is successfully completed.

Tailored services

We will provide the most suitable business plan based on your situation.

Traceable process

Simon has an online system for you to track any updates to the project.

Frequently Asked Questions

Do you have any further questions? don’t worry! We are happy to answer!

What types of companies are suitable for CFO outsourcing?

CFO outsourcing is suitable for various types of companies, especially:

- Small and medium-sized enterprises and startups: These companies may not have the budget to hire a full-time CFO

- Companies that require financial expertise: If a company lacks internal financial management capabilities but requires advanced financial strategic support

- Multinational corporations: Foreign companies in China that require professional financial management support

- Companies with specific project requirements, such as financial auditing, budget preparation, mergers and acquisitions, or financing needs

How is the outsourcing fee for the Chief Financial Officer calculated?

The outsourcing fee for the Chief Financial Officer is usually calculated as follows:

- Hourly rate: The cost is based on the hourly rate set by the Chief Financial Officer’s outsourcing provider

- Project based costs: Charging for specific projects, such as financial audits or budget preparation

- Fixed monthly fee: Based on the company’s needs and service scope, a fixed fee is paid every month

- Costs based on company size or financial complexity: Some suppliers charge based on the complexity of company size or its financial needs

The most suitable method will be determined based on your specific needs and company size. You can further communicate with Hongda, and we will provide you with a more detailed plan.

Can outsourcing the Chief Financial Officer meet the needs of companies of different sizes?

Yes, CFO outsourcing services can be tailored to meet the needs of companies of all sizes. Whether it is a small business or a large multinational corporation, outsourcing CFOs can provide customized services to address specific financial challenges of the company.

Does outsourcing the Chief Financial Officer affect the company's financial independence and control?

Generally speaking, outsourcing CFO does not affect the financial independence or control of the company. The work of the outsourced CFO remains aligned with the company’s senior management and strategy, and the company retains ultimate control over financial decisions. The role of an outsourced CFO is to provide support and advice, rather than making decisions on behalf of the company.